.webp)

Revenue Cycle Management

Revenue Cycle ManagementHow Accurate Patient Eligibility Verification Prevent Claim Denials

Content

Accurate patient eligibility verification plays a pivotal role in ensuring the smooth functioning of medical practices and healthcare facilities. This process involves confirming a patient's insurance coverage, benefits, and eligibility before rendering services—a seemingly straightforward task that often presents significant challenges.

Errors or delays in eligibility verification can lead to claim denials, delayed payments, and administrative headaches, directly impacting a healthcare provider's financial health and operational efficiency. Common challenges include miscommunication between providers and insurers, incorrect patient information, and frequent changes in insurance plans.

These hurdles underscore the critical need for a robust, accurate, and timely verification process. Beyond minimizing claim denials, it helps healthcare providers deliver better patient experiences, reduce administrative burdens, and improve revenue cycle management. This blog delves into the importance of accurate patient eligibility verification, its role in preventing claim denials, and actionable strategies to optimize the process.

Impact of Claim Denials on Healthcare Providers

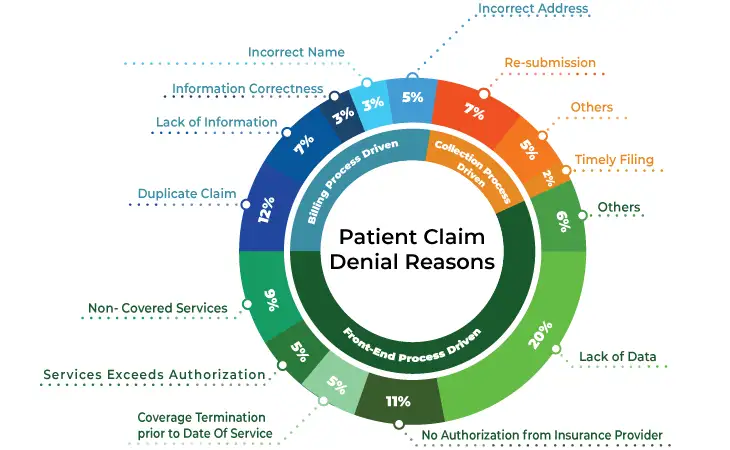

Claim denials occur when an insurance payer refuses to reimburse a healthcare provider for a service or procedure. According to industry estimates, nearly 10% of claims are denied on the first submission, and many of these denials are preventable. The financial and operational impact of claim denials includes:

- Revenue Loss: Denied claims often result in a direct loss of revenue if they are not resubmitted or appealed successfully.

- Increased Administrative Costs: Processing denied claims requires additional resources, time, and effort from billing teams.

- Disrupted Cash Flow: Delayed reimbursements due to denials can strain a provider’s financial stability.

- Patient Dissatisfaction: When claims are denied, patients may become responsible for unexpected out-of-pocket costs, leading to dissatisfaction and mistrust.

Understanding Patient Eligibility Verification

Patient eligibility verification is the process of confirming a patient’s insurance coverage and benefits before rendering healthcare services. This involves validating:

- Active Coverage: Ensuring the patient’s insurance policy is active on the date of service.

- Covered Services: Confirming that the services provided are included under the patient’s insurance plan.

- Co-Pays, Deductibles, and Out-of-Pocket Maximums: Understanding the patient’s financial responsibility.

- Preauthorization Requirements: Identifying services that require prior approval from the insurance payer.

10 Ways Accurate Patient Eligibility Verification Prevents Claim Denials

Accurate patient eligibility verification plays a crucial role in preventing claim denials. Here are 10 ways it can help:

1. Ensures Correct Insurance Coverage

Accurate patient eligibility verification ensures that the patient’s insurance plan covers the intended services. By confirming coverage beforehand, providers avoid performing treatments that may not be reimbursed. This proactive approach eliminates unnecessary financial stress for both patients and healthcare facilities.

When coverage is confirmed, providers can discuss any uncovered expenses with patients in advance. This transparency builds trust and ensures informed consent before services are rendered. By preventing coverage-related claim denials, healthcare organizations maintain steady revenue and improve overall patient satisfaction.

2. Reduces Data Entry Errors

Eligibility verification involves cross-checking patient details, such as names, policy numbers, and group IDs, with insurer records. This process minimizes errors in claim submissions, reducing the chances of rejection. Accurate data entry also ensures faster claim processing, saving time and resources for all parties involved.

Mistakes like typos or incorrect policy numbers are common causes of claim denials. Verification allows providers to catch and correct these errors early. With accurate information, insurance companies are more likely to process claims without delays, improving operational efficiency for healthcare practices.

3. Verifies Policy Limitations

Through verification, providers can identify specific policy limitations such as excluded services, pre-authorization requirements, or waiting periods. This knowledge prevents claims for non-covered treatments, which are common causes of denials. It also helps avoid disputes with patients over unexpected bills.

Discussing policy limitations upfront allows patients to make informed decisions about their care. Providers can explore alternative treatments or payment arrangements when needed. This proactive approach minimizes claim rejections and enhances financial predictability for both patients and healthcare providers.

4. Clarifies Co-Pays and Deductibles

Eligibility verification reveals patient responsibilities like co-pays and deductibles before services are provided. Understanding these financial obligations upfront helps avoid surprises and ensures timely collection of payments. This reduces the risk of claims being denied due to unfulfilled patient contributions.

Providers can educate patients about their payment obligations during eligibility checks. This transparency ensures patients are prepared to meet their financial responsibilities. It also prevents claim rejections caused by unmet deductibles, streamlining the reimbursement process.

5. Detects Coordination of Benefits (COB) Issues

Eligibility verification identifies if a patient has multiple insurance plans and determines the primary payer. Resolving COB issues upfront prevents claim denials related to payer conflicts. Accurate coordination ensures the claim is submitted to the right insurer first.

By clarifying primary and secondary insurance coverage, healthcare providers avoid delays caused by incorrect billing. This also reduces administrative back-and-forth, allowing faster claim processing and maintaining a positive patient experience.

6. Identifies Active vs. Terminated Policies

Checking eligibility ensures the patient’s policy is active at the time of service. Terminated or inactive policies often result in denied claims. Early detection of coverage status allows providers to address the issue before proceeding with treatment.

Providers can work with patients to explore alternative payment options if insurance is no longer active. This avoids wasted resources on unpayable claims and ensures financial sustainability for healthcare organizations.

7. Prevents Pre-Authorization Issues

Some procedures require pre-authorization from the insurer. Eligibility verification flags these requirements, allowing providers to secure approval before treatment. Claims for services lacking pre-authorization are often denied, so proactive measures are crucial.

By confirming pre-authorization needs, providers can avoid delays in claim processing. This ensures smoother reimbursement workflows and prevents unnecessary financial losses due to oversight.

8. Ensures Accurate Patient Demographics

Verifying patient demographic information, such as address and contact details, prevents mismatches in insurer records. Inaccurate demographics can lead to claim rejections or delays in communication. Accurate data entry improves claim acceptance rates and facilitates seamless correspondence.

Providers can update patient information during verification, ensuring that claims are submitted with the correct details. This attention to accuracy minimizes administrative headaches and enhances the overall efficiency of billing operations.

9. Improves Revenue Cycle Management (RCM)

Accurate eligibility verification is a cornerstone of effective RCM. It ensures claims are submitted correctly the first time, reducing denials and increasing cash flow. Providers can focus on delivering care without constant financial interruptions caused by claim rejections.

Timely verification also accelerates reimbursements, keeping revenue cycles healthy. This strengthens the financial stability of healthcare organizations and supports their long-term growth.

10. Enhances Patient Experience

Eligibility checks ensure patients are informed about coverage, out-of-pocket costs, and potential payment options before receiving care. This transparency builds trust and reduces stress. Patients appreciate knowing what to expect financially, which enhances their overall experience.

When claims are processed smoothly, patients avoid the frustration of unexpected bills or denied claims. Clear communication during verification fosters positive relationships and long-term loyalty to the healthcare provider.

Conclusion

The future of patient eligibility verification lies in automation, AI-driven analytics, and real-time data integration. However, managing this process is complex due to varying insurance policies, frequent regulation changes, and coordination with multiple stakeholders. Errors in verification can lead to claim denials, revenue loss, and patient dissatisfaction.

Partnering with a third-party provider streamlines the process by leveraging expertise, advanced technology, and scalable solutions, ensuring accurate and timely insurance verification. Invensis, a leading outsourcing services provider, delivers comprehensive insurance verification services tailored to healthcare organizations.

We offer end-to-end services, including verifying patient coverage, pre-authorizations, policy updates, and benefits checks. With our skilled professionals and cutting-edge tools, we reduce administrative burdens, minimize errors, and improve claim approval rates. Contact Invensis today to streamline patient eligibility verification and optimize your healthcare operations!

Discover Our Full Range of Services

Click HereExplore the Industries We Serve

Click HereBlog Category

Related Articles

Optimize your store in 2026 with the best WooCommerce order management plugins. Automate order tracking, inventory, and customer service for success.

January 21, 2026

|

Find the leading accounting firms in Singapore trusted by businesses for audit, tax, and advisory services.

November 6, 2025

|

Explore the leading accounting firms in South Africa providing expert audit, tax, cloud accounting, and payroll services. Learn about their key features and unique offerings.

February 2, 2026

|

Services We Provide

Industries We Serve

.webp)