Content

Evaluating third-party vendors is a crucial task for organizations seeking reliable partnerships and seamless operations in today's business landscape. Whether it's hiring a partner for IT solutions, partnering with marketing agencies, or engaging suppliers for raw materials, evaluating them is essential.

However, entrusting external entities with critical functions also introduces risks that can significantly impact an organization's reputation, security, and bottom line. That's why it's paramount for organizations to adopt a meticulous and comprehensive approach when evaluating potential third-party vendors.

The quality of third-party vendors, their expertise, the compliance they adhere and the practices they follow directly impacts your organization's success and resilience. Consequently, it becomes imperative for businesses to implement robust evaluation strategies to select reliable and trustworthy partners.

How can you be certain that a potential vendor will align with your organization's values, deliver on their promises, and protect your sensitive information? Here is where a meticulous evaluation process becomes indispensable. This blog will explore four valuable tips organizations can employ for third-party vendor assessment process.

Importance of Assessing Third-Party Vendors

Here are key reasons why this assessment is important:

- Risk Mitigation: Evaluating vendors helps identify potential security vulnerabilities, protecting sensitive data from breaches and ensuring compliance with regulatory standards.

- Regulatory Compliance: Ensures third-party vendors adhere to industry standards, avoiding penalties and safeguarding the organization's reputation.

- Operational Continuity: Assessments verify vendor reliability, minimizing disruptions and maintaining seamless operations in critical business functions.

- Cost Efficiency: Early evaluation prevents hidden costs by analyzing contracts, performance, and service quality, ensuring value for money.

- Reputation Management: Safeguards the company’s image by ensuring vendors meet ethical and quality standards, reducing risks of public scrutiny.

- Performance Assurance: Regular assessments ensure vendors deliver on agreed service levels, maintaining product and service quality.

- Supply Chain Integrity: Identifies weak links in the vendor network, fostering a robust and resilient supply chain ecosystem.

- Strategic Alignment: Ensures third-party services align with organizational goals and values, enhancing synergy and business growth.

Third-Party Vendor Assessment: 4 Best Practices

When conducting third-party vendor assessments, it's crucial to ensure robust risk management and compliance. Here are four best practices to do a third-party vendor audit:

Tip 1: Assess Vendor Experience in Handling Your Requirements

Significance of Assessing Vendor Experience in Handling Requirements

Assessing how third-party vendors can handle your requirements is crucial for ensuring a successful partnership. Organizations can mitigate risks and avoid potential issues by evaluating their ability to meet your specific needs. A thorough assessment helps determine if the vendor possesses the expertise, resources, and technologies to address your requirements effectively. It allows organizations to align their expectations with the vendor's capabilities, reducing the likelihood of miscommunication or unsatisfactory deliverables. Additionally, assessing the vendor's track record in handling similar requirements provides insights into their reliability and competence.

Benefits of Assessing Vendor Experience in Handling Requirements

Assessing the experience of third-party vendors in handling your requirements offers numerous benefits to organizations. Firstly, it provides confidence that the vendor has dealt with similar challenges in the past, ensuring they possess the necessary expertise and skills to address your specific needs effectively. This leads to improved service quality and reduces the risk of project failures.

Additionally, by evaluating a vendor's experience, organizations can gain insights into their track record of success. This includes their ability to meet deadlines, maintain quality standards, and overcome obstacles. It allows you to select a vendor with a proven performance history, increasing the likelihood of achieving desired outcomes.

Tip 2: Conduct a Thorough Vendor Assessment

Importance of Evaluating Potential Vendors

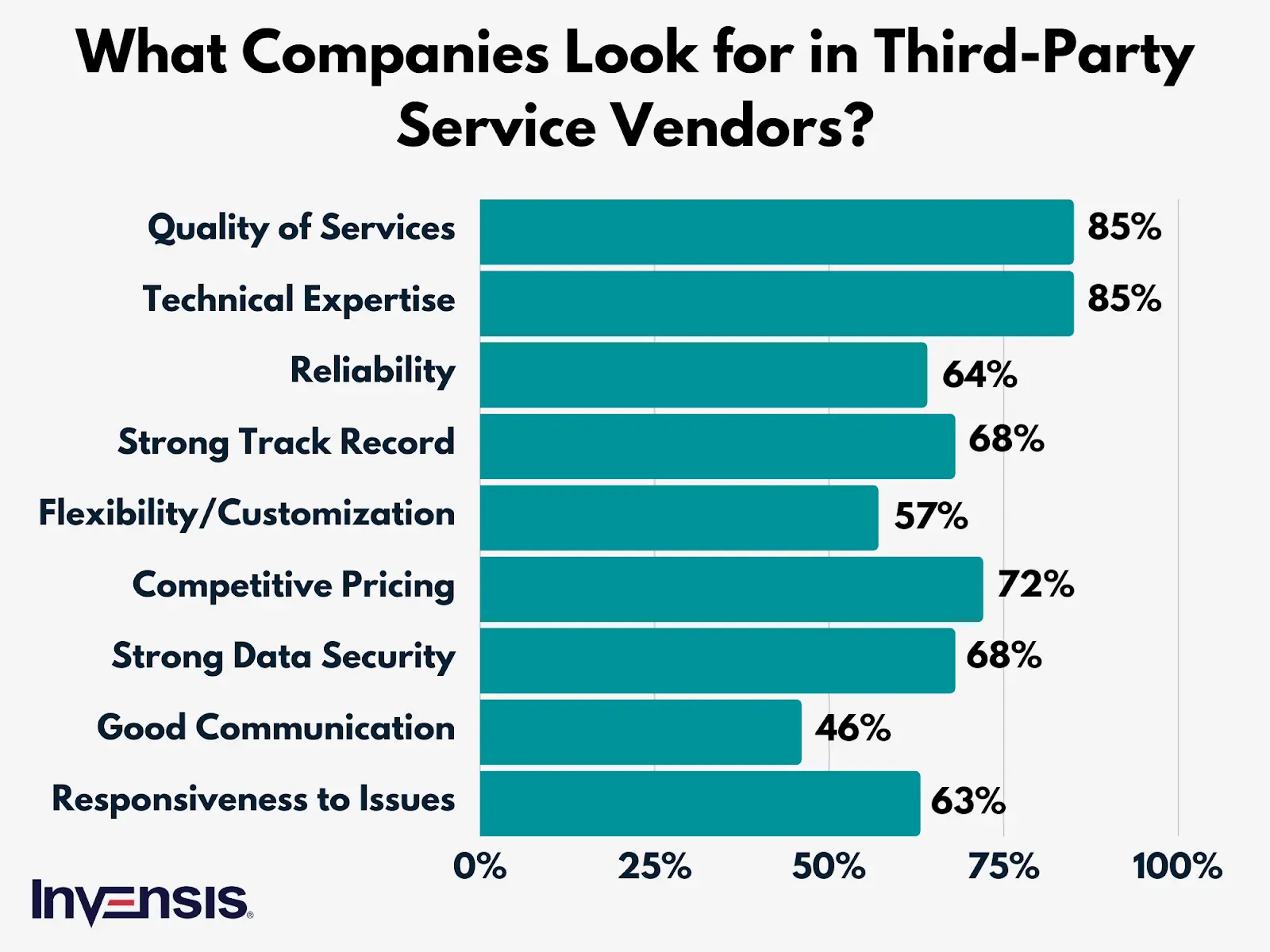

Assessing the reputation, experience, and track record of potential vendors is crucial for making informed decisions. By assessing these aspects, organizations can gauge a vendor's reliability, trustworthiness, proven expertise, risk mitigation abilities, quality of products or offerings, customer satisfaction focus, long-term partnership potential, and industry recognition.

A vendor with a solid reputation and extensive experience is more likely to deliver on promises, possess the necessary expertise, mitigate risks effectively, deliver high-quality solutions, prioritize customer satisfaction, and have the potential for a successful long-term partnership. Industry recognition further validates a vendor's credentials and contributions to the industry.

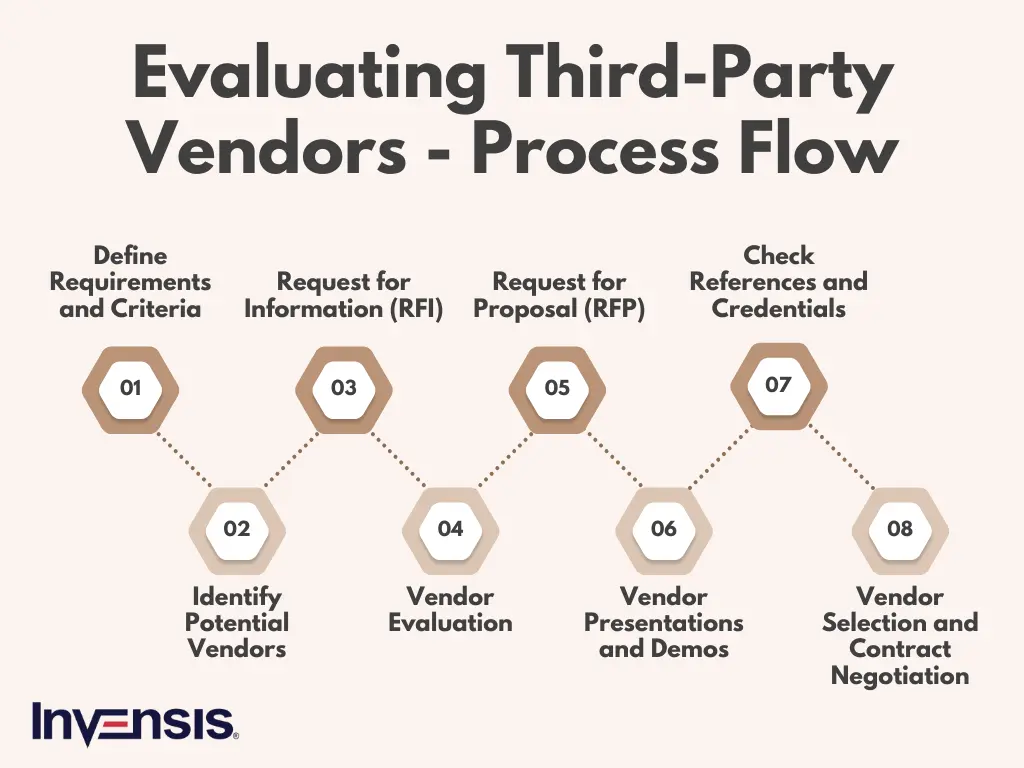

Process of Conducting a Comprehensive Evaluation of Potential Vendors

Conducting a comprehensive evaluation of potential vendors involves several essential steps. First, establish evaluation criteria based on capabilities, experience, pricing, support, and reputation. Then, research and identify candidates through market research and recommendations. Request information from selected vendors and evaluate their responses.

Conduct interviews and demos with shortlisted vendors, check references, and perform due diligence. Assess vendor stability, consider risk mitigation, and conduct site visits if necessary. Develop a scoring system to objectively compare vendors and make a well-informed decision that aligns with your organization's goals and requirements.

Assess Vendor Financial Stability and Compliance with Industry Regulations

When evaluating vendors, it is crucial to assess their financial stability and compliance with industry regulations. This assessment is important to ensure vendors have the necessary resources and stability to provide ongoing support, minimize the risk of business disruptions, operate within legal boundaries, adhere to industry standards, and avoid potential legal and reputational risks.

Additionally, assessing vendors' compliance with data protection regulations is essential to safeguard sensitive information, and verifying that vendors have appropriate processes, documentation, and controls helps meet regulatory obligations. By considering these factors, organizations can select vendors who demonstrate financial stability and comply with important regulations, reducing potential risks and ensuring a secure and compliant partnership.

Tip 3: Evaluate Security and Data Protection Measures

Need for Assessing the Security Practices of Third-Party Vendors

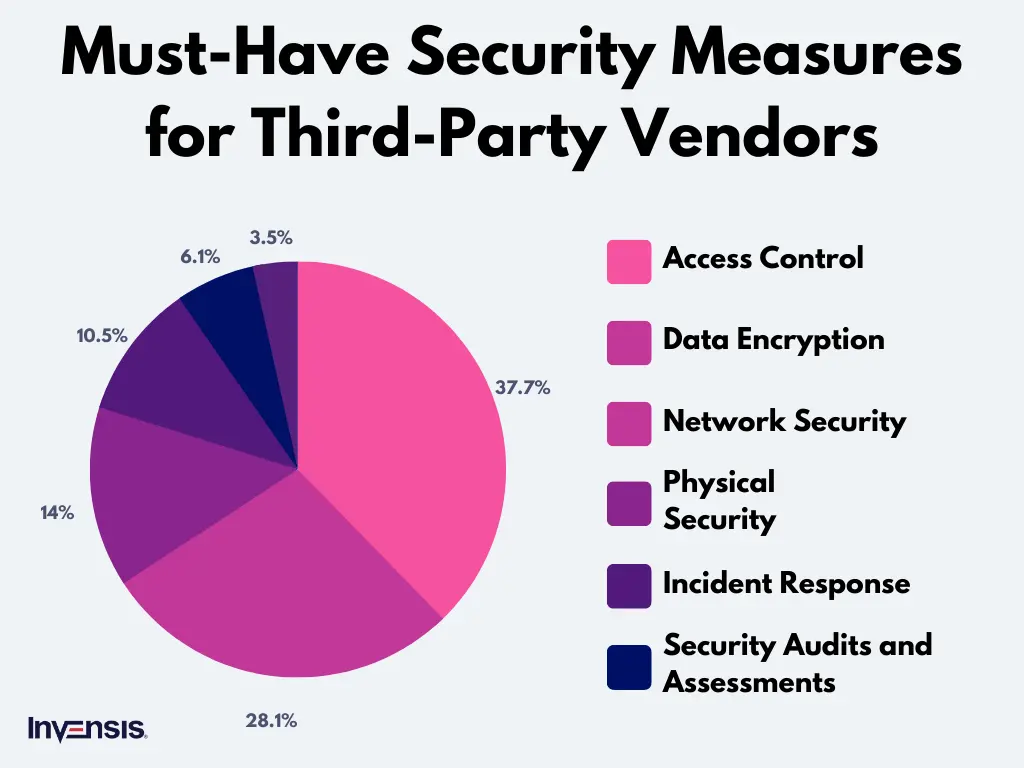

Assessing the security practices of third-party vendors is crucial for organizations due to several reasons. It ensures data protection and privacy by implementing measures to safeguard sensitive information. Evaluating security practices helps identify and mitigate potential vulnerabilities, reducing the risk of security incidents and associated consequences.

Assessing vendors' security practices ensures compliance with industry regulations, minimizing non-compliance risk. It also helps maintain business continuity by implementing measures to minimize downtime and recover effectively from security incidents. Assessing security practices maintains the overall security of the supplier ecosystem and establishes trust with vendors, protecting the organization's reputation. Additionally, including specific security requirements in contractual agreements holds vendors accountable and ensures adherence to the organization's security standards.

Importance of Evaluating Data Protection Measures

Evaluating the data protection measures of third-party vendors is of utmost importance. By assessing encryption practices, access controls, and disaster recovery plans, organizations can safeguard data confidentiality, integrity, and availability. Evaluating encryption practices ensures that sensitive data remains protected from unauthorized access.

Assessing access controls provides assurance that only authorized personnel can access the data. Evaluating data protection measures also offers insights into a vendor's accountability and transparency. Reviewing disaster recovery plans helps assess a vendor's ability to recover from data loss, system failures, or natural disasters. By considering these factors, organizations can select vendors who prioritize data protection and have robust measures in place to mitigate risks and ensure the security and availability of their data.

Examples of Security Certifications or Standards Organizations Should Look for

When evaluating vendors, organizations should consider various security certifications and standards as indicators of robust security measures. Examples of these certifications and standards include:

- ISO 27001 - Demonstrates the implementation of an information security management system based on best practices.

- SOC 2 - Assesses controls related to security, availability, processing integrity, confidentiality, and privacy.

- PCI DSS - Ensures security controls for handling credit card data.

- HIPAA/HITECH - Establishes security and privacy requirements for protected health information.

- GDPR - Ensures compliance with data protection and privacy regulations for EU residents.

Considering these certifications and standards helps organizations assess a vendor's commitment to maintaining robust security measures and compliance with specific industry requirements.

Tip 4: Consider Scalability and Flexibility

Importance of Considering Scalability and Flexibility

Considering scalability and flexibility is crucial for long-term success when evaluating vendors. Scalability ensures that the vendor's solutions can accommodate future business growth without significant disruptions. Flexibility allows the vendor to adapt their offerings to meet evolving needs, ensuring continued efficiency and effectiveness. Scalable solutions often provide long-term cost savings by minimizing upfront investments and ongoing maintenance costs.

Additionally, scalable and flexible vendors are more agile, innovative, and aligned with long-term partnership goals. They reduce the risk of vendor lock-in and future-proof technology investments, allowing for sustainable and adaptable technology infrastructure. By considering scalability and flexibility, organizations can select vendors that can grow, adapt, and support their long-term objectives.

Significance of Assessing their Ability to Adapt to Changing Business Needs and Technologies

Assessing a vendor's ability to adapt to changing business needs and technologies holds significant importance for several reasons. Vendors that can quickly adapt to changing business needs help organizations maintain agility and responsiveness in a dynamic marketplace. Embracing new technologies and innovation aligns the vendor's offerings with the latest capabilities, enabling the organization to stay competitive.

Adaptable vendors bring innovation and novel approaches to address business challenges, providing a competitive advantage. Additionally, vendors that are open to feedback and collaborative partnerships foster a strong vendor-client relationship, working closely to meet specific needs. Considering a vendor's ability to adapt to changing business needs and technologies ensures a more effective and mutually beneficial partnership.

Conclusion

Choosing a reliable third-party partner will become increasingly challenging for various reasons. A safe option is to bank on a partner with longstanding market experience. Their experience attests to their track record, making them more reassuring when considering the risks associated with outsourcing. An experienced partner can navigate complexities efficiently, offering high-quality services and compliance with industry standards. This strategic choice fosters long-term success and stability for your business.

Invensis is a leading third-party vendor with over 24 years of market experience. We provide back-office support solutions for domains such as finance and accounting services, logistics, revenue cycle management, customs brokerage, and more. Our clients believe in our quality and efficiency, which makes them repeatedly do business with us. Talk to us now about our list of solutions that can boost your business growth.

Frequently Asked Questions

Discover Our Full Range of Services

Click HereExplore the Industries We Serve

Click HereBlog Category

Related Articles

Find the leading accounting firms in Singapore trusted by businesses for audit, tax, and advisory services.

November 6, 2025

|

Explore the leading accounting firms in South Africa providing expert audit, tax, cloud accounting, and payroll services. Learn about their key features and unique offerings.

November 6, 2025

|

Explore what project accounting is, how it works, and why it’s essential for businesses. Understand key principles, revenue recognition methods, and best practices to improve your knowledge.

October 7, 2025

|

Services We Provide

Industries We Serve

.webp)