Finance & Accounting

Finance & AccountingTop 6 Solutions to Overcome Accounts Receivable Challenges

Content

Managing accounts receivable (AR) efficiently is essential for maintaining a healthy cash flow and ensuring the financial stability of any business. It represents the money owed to a company by its customers for goods or services delivered but not yet paid for. When AR is managed well, it ensures that the company has a steady inflow of cash and can meet its operational expenses, invest in growth opportunities, and maintain overall financial stability.

However, many companies face significant accounts receivable challenges. Such issues not only stifle a company's growth by tying up funds that could be used for expansion or innovation but also strain customer relationships. In severe cases, poor accounts receivable management leads to a cash flow crisis, inability to pay suppliers, or even bankruptcy.

This blog discusses the top 6 solutions to overcome accounts receivable challenges in 2025. It also aims to help businesses refine their cash flow management and strengthen financial resilience.

How to Overcome Common Accounts Receivable Challenges in 2025: Top 6 Ways

Accounts receivable challenges could be overcome quickly if businesses take control of their accounts receivable process. However, before that, they must understand the right ways. Here are the best ways to overcome accounts receivable problems:

1. Reduce DSO

Reducing Days Sales Outstanding (DSO) is a critical strategy for improving accounts receivable management. DSO measures the average days a company takes to collect payment after a sale. A high DSO indicates that a company is taking longer to collect its receivables, which can strain cash flow. This delay in cash inflow can cause significant financial stress, forcing businesses to rely on external financing options to cover their operational expenses, which can be costly and impact profitability.

Additionally, a high DSO may signal underlying issues such as inefficient billing processes, inadequate follow-up on outstanding invoices, or poor customer credit management. By focusing on reducing DSO, companies can not only improve their cash flow but also enhance their overall financial health, ensuring they have the necessary liquidity to invest in growth opportunities and maintain smooth operations. This proactive approach to managing receivables ultimately contributes to a more stable and financially resilient business environment.

2. Improve AR Productivity

Improving your AR productivity is closely linked to how an AR process is conducted. Even though most businesses use their ERP or accounting system for AR management, they still require significant manual labor and time to manage the invoice collection process. Due to these manual processes, the collectors spend a lot of time looking for customer information, updating spreadsheets, correcting data errors, and other non-value-adding activities. This hinders their focus on communicating with customers, settling disputes, and performing other activities that would expedite payment.

Automating the AR process might be the right step toward overcoming accounts receivable challenges and enhancing AR productivity. By automating the process and centralizing AR data, businesses could provide collectors the time required to focus on core activities that would help them get paid faster. By implementing an automated solution, they can streamline business processes and enable the AR team to improve cash flow while reducing operating costs and enhancing customer service. Other benefits include the ability of collectors to pre-empt customer disputes or payment delays, eliminating the need for rekeying order information, reducing the need for invoice filing, and lowering storage costs.

3. Reduce Portfolio Risks

Understanding customers is critical to managing portfolio risks associated with accounts receivable. There is a distinct difference between good credit risk and bad credit risk. Some factors that differentiate the two include customers' changing creditworthiness over time, poor monitoring of customer creditworthiness, bad customer references, or failure to verify customer references. Businesses could avoid several such bad practices by having a credit application form filled in by all customers.

Repeat credit increase requests should be noted. Therefore, businesses need to consider creating a credit score for each customer and make changes to the same as when customers pay early or late or default. They also should understand that customer creditworthiness would change over time. Therefore, it is important to ensure they are in good financial health before giving them additional credit or doing further business with them.

4. Perform An Analysis

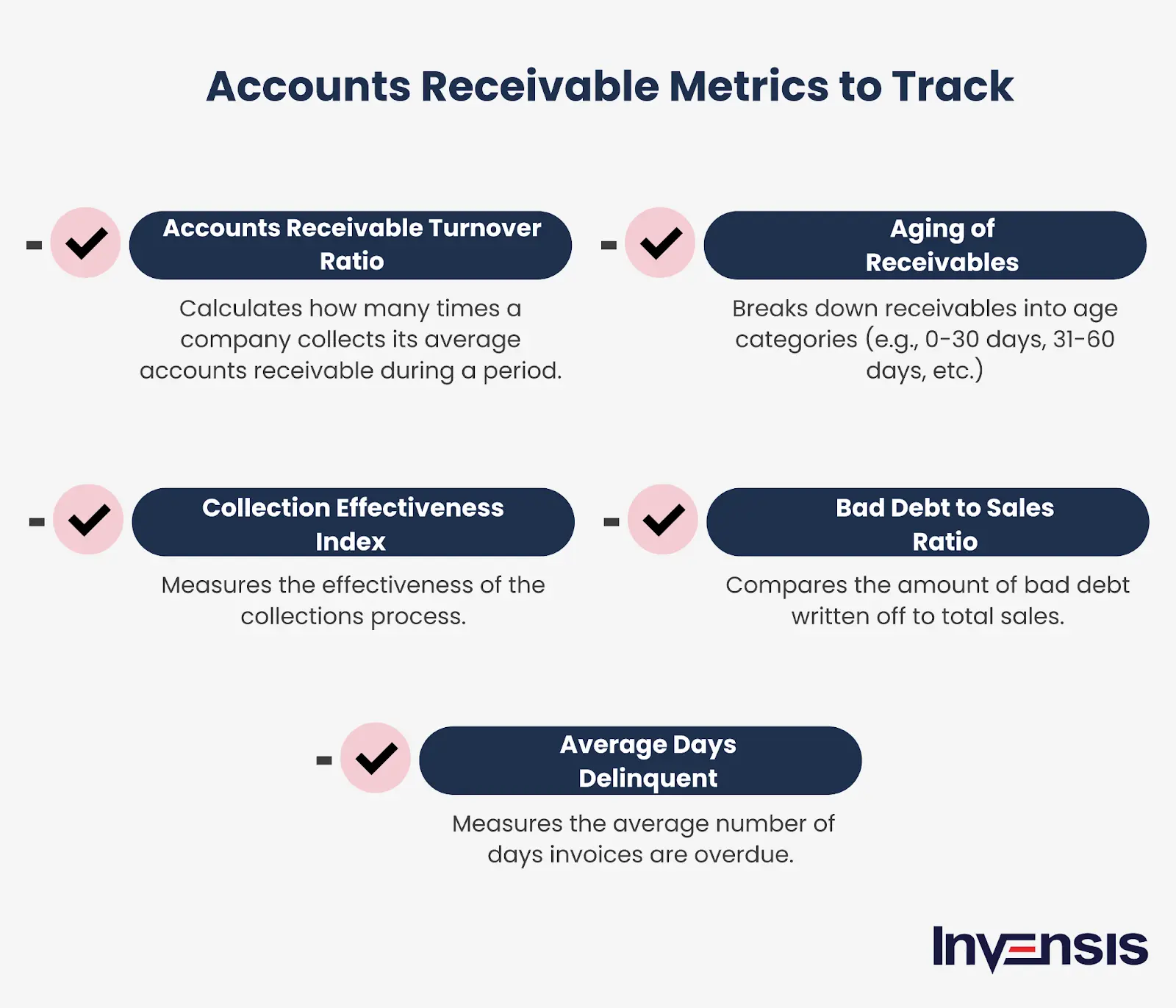

Regular analysis and reporting of accounts receivable data are essential for identifying trends, spotting potential issues, and making informed decisions. Businesses should routinely review AR aging reports to track overdue invoices and prioritize collection efforts. Conducting root cause analysis on disputed or late payments can help uncover underlying issues that need addressing. Implementing key performance indicators (KPIs) such as DSO, the percentage of overdue invoices, and the collection effectiveness index can provide valuable insights into the AR process's efficiency.

Regular reporting ensures that management clearly views the company's receivables status, enabling proactive measures to mitigate risks and improve collections. Companies can enhance transparency, accountability, and overall AR performance by maintaining a robust analysis and reporting framework.

5. Enhance Collection Strategies

Enhancing collection strategies involves adopting a systematic and proactive approach to collecting outstanding receivables. Businesses should establish clear policies and procedures for collections, including a schedule for sending reminders and making follow-up calls. Using a tiered approach—starting with gentle reminders and escalating to more assertive actions if necessary—can be effective. Leveraging technology, such as automated reminders and payment portals, can streamline the collection process and make it easier for customers to pay.

Offering incentives for early payments or implementing penalties for late payments can also motivate timely settlements. Regularly training the AR team on negotiation and conflict resolution skills can improve their effectiveness in collecting overdue amounts. By enhancing collection strategies, businesses can reduce overdue receivables, improve cash flow, and maintain healthy financial operations.

6. Strengthen Customer Relationships

Building and maintaining strong customer relationships is fundamental to effective accounts receivable management. Good relationships encourage timely payments and reduce the likelihood of disputes. Clear and open communication is key—ensuring that customers understand the payment terms and addressing any concerns promptly can foster trust and cooperation. Offering flexible payment options and being responsive to customer needs can also enhance relationships.

Regularly engaging with customers through follow-ups, reminders, and feedback sessions helps keep the lines of communication open. Businesses can create a positive environment that encourages prompt payments and resolves issues amicably by treating customers as partners and not just revenue sources.

Conclusion

In the future, account receivable processes will become more streamlined, efficient, and data-driven by technological advancements, evolving business practices, and the increasing complexity of global markets. Technologies such as artificial intelligence (AI) and machine learning will play a crucial role in predicting payment behaviors, identifying potential risks, and automating routine tasks like invoicing and payment reminders.

However, these advancements also bring new challenges for businesses. Managing the integration of new technologies with existing systems will be a significant challenge for them. Likewise, ensuring seamless interoperability and data accuracy can be complex and resource-intensive. This is where delegating AR functions can provide a strategic solution to these challenges.

Invensis has more than 24 years of experience and expertise in efficiently managing complex accounts receivable processes. We stay updated with regulatory changes and industry best practices to ensure compliance and reduce the risk of errors. We help businesses focus on their core activities while our experts handle accounts receivable functions. Contact us now to address your current AR challenges and position your business for success with our accounts receivable services.

FAQs

Discover Our Full Range of Services

Click HereExplore the Industries We Serve

Click HereBlog Category

Related Articles

Find the leading accounting firms in Singapore trusted by businesses for audit, tax, and advisory services.

November 6, 2025

|

Explore the leading accounting firms in South Africa providing expert audit, tax, cloud accounting, and payroll services. Learn about their key features and unique offerings.

November 6, 2025

|

Explore what project accounting is, how it works, and why it’s essential for businesses. Understand key principles, revenue recognition methods, and best practices to improve your knowledge.

October 7, 2025

|

Services We Provide

Industries We Serve

.webp)